Digital yuan hongbao now comes with interest

China’s banks are rolling out digital yuan red envelopes (hongbao) and payment discounts ahead of Lunar New Year to boost consumption.

Red envelopes are a Lunar New Year tradition in China and parts of Asia in which money is gifted to loved ones as a symbol of sharing good fortune. In recent years, the practice has been digitized through mobile payments and the central bank digital currency (CBDC). In mainland China, the Lunar New Year period is known as the Spring Festival and is one of the country’s peak retail spending seasons.

The 2026 holiday is the first since authorities allowed digital yuan wallet balances to earn interest. Local media outlets have claimed that the new feature has encouraged users to keep larger balances in their digital yuan wallets ahead of the holidays.

Before the end of the 2025 calendar year, the People’s Bank of China said that the digital yuan is ditching its digital cash model in favor of one treated as digital deposits. Wallet balances are now recorded as commercial bank liabilities.

In the US, major industry players, including Coinbase, withdrew support for the crypto market structure bill due to disagreements that included stablecoin interest provisions.

Banking groups have pushed to ban stablecoin yield, arguing that interest-bearing tokens could blur regulatory lines. The crypto industry has countered that prohibiting yield weakens the competitiveness of dollar-backed stablecoins relative to overseas rivals like the digital yuan.

Despite the new interest-bearing feature, digital yuan adoption remains isolated to China. The currency is distributed through designated commercial banks and operates within Beijing’s tightly managed financial system. It is not freely transferable across borders and does not compete in open crypto markets.

Mainland China has banned key crypto activities, including trading and mining, while its Special Administrative Region, Hong Kong, operates under a separate regulatory framework that permits licensed activities. The city is expected to approve its first batch of stablecoin licenses in the first quarter of 2026.

South Korean giants move into crypto exchanges

One of South Korea’s largest fintech platforms, Toss, is reportedly reviewing the acquisition of an overseas crypto exchange through its US subsidiary.

According to unnamed industry officials cited by local crypto outlet Bloomingbit, Toss is believed to be eyeing foreign platforms focused on institutional trading.

Toss, operated by Viva Republica, runs an internet-only bank and a retail brokerage through its finance app. In August, it said its cumulative user base had reached 30 million, roughly 60% of the country’s population.

South Korean financial institutions and internet giants have been rushing to acquire crypto exchanges, though Toss’s reported overseas ambitions differ from the recent domestic acquisition drive.

Mirae Asset, whose asset management arm is among the largest ETF issuers in Asia, has agreed to a deal worth nearly $100 million to acquire Korbit, one of South Korea’s five licensed exchanges.

Upbit, the country’s largest exchange, is operated by Dunamu. Naver Financial is seeking to acquire Dunamu through a comprehensive share-swap deal that would make it a wholly owned subsidiary, valuing the company at more than $10 billion, although proposed ownership limits on exchange shareholders could complicate the transaction.

In October, Binance reportedly acquired local exchange Gopax, while Coinbase has been involved in rumors to snap up Coinone.

Read also

Features

EU’s privacy-killing Chat Control bill delayed — but fight isn’t over

Features

Why are crypto fans obsessed with micronations and seasteading?

Japanese conglomerate to acquire Coinhako

The crypto exchange acquisition FOMO is not limited to South Korea.

On Friday, Japan’s SBI Holdings announced plans to acquire a majority stake in Singapore-based digital asset platform Coinhako.

SBI said its wholly owned subsidiary, SBI Ventures Asset, has signed a letter of intent with Holdbuild, Coinhako’s parent company. The proposed transaction includes a capital injection into Coinhako Group as well as the purchase of shares from several existing shareholders.

Coinhako operates primarily through Hako Technology, a Singapore-licensed payment, and Alpha Hako, a crypto service provider regulated in the British Virgin Islands.

With the institutionalization of crypto, large financial groups have largely opted to acquire licensed exchanges in key jurisdictions, such as South Korea and Singapore, instead of launching their own trading platforms.

Read also

Features

Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder

Features

How to control the AIs and incentivize the humans with crypto

China’s green energy on blockchain

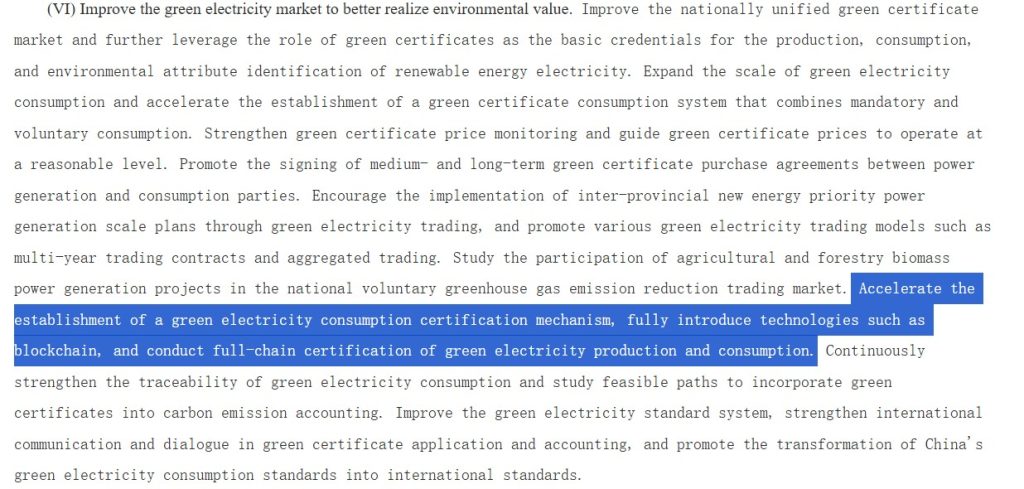

China’s State Council has set a target of establishing a unified national electricity market by 2030, with roughly 70% of total power consumption conducted through market-based trading.

The plan calls for full nationwide spot market operation by 2027 and deeper integration of inter-provincial electricity trading by 2030. By 2035, China aims to ensure that the multi-dimensional value of electricity — such as energy, capacity and environmental attributes — is reflected in market pricing.

As part of the framework, regulators said they will accelerate the creation of a national green electricity consumption certification system and “fully introduce technologies such as blockchain” to enable full verification of renewable power generation and consumption.

The system is intended to strengthen the traceability of green electricity use and could support the integration of green certificates into carbon accounting mechanisms.

The policy frames blockchain as infrastructure supporting renewable energy certification and carbon management. China’s crypto crackdown targeted speculative tokens, not blockchain infrastructure, which remains a national strategic priority.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan (Hyoseop) Yun is a Cointelegraph staff writer and multimedia journalist who has been covering blockchain-related topics since 2017. His background includes roles as an assignment editor and producer at Forkast, as well as reporting positions focused on technology and policy for Forbes and Bloomberg BNA. He holds a degree in Journalism and owns Bitcoin, Ethereum, and Solana in amounts exceeding Cointelegraph’s disclosure threshold of $1,000.

Asia Express,Columns#Chinese #Year #boosts #interest #TradFi #buying #crypto #exchanges #Asia #Express1771279450