Uranium stocks are gaining attention because global energy markets are shifting toward low-carbon power and nuclear energy is making a comeback. With rising uranium prices, strong demand from utilities, and long-term contracts being signed worldwide, uranium producers and developers are among the most talked-about plays for 2026.

Uranium is the primary fuel for nuclear reactors, and a tightening supply due to years of underinvestment in new mines could push prices and producer profits higher over the next few years.

This article explores five of the most promising uranium-related stocks for 2026.

1. Cameco Corporation (NYSE: CCJ)

Overview: Cameco is widely recognized as one of the leading uranium producers in the world. With major mining operations in Canada’s Athabasca Basin, including high-grade assets like McArthur River and Cigar Lake, Cameco has a deep operational footprint and tier-one production capacity.

Why It Matters: Cameco’s long history in uranium mining gives it scale and stability. The company also owns impressive stakes in nuclear fuel services and other segments of the fuel cycle, which gives it diversified exposure beyond just mining alone. Cameco’s shares have benefitted from rising uranium prices and increased global nuclear activity, making it a core name in uranium investment strategies.

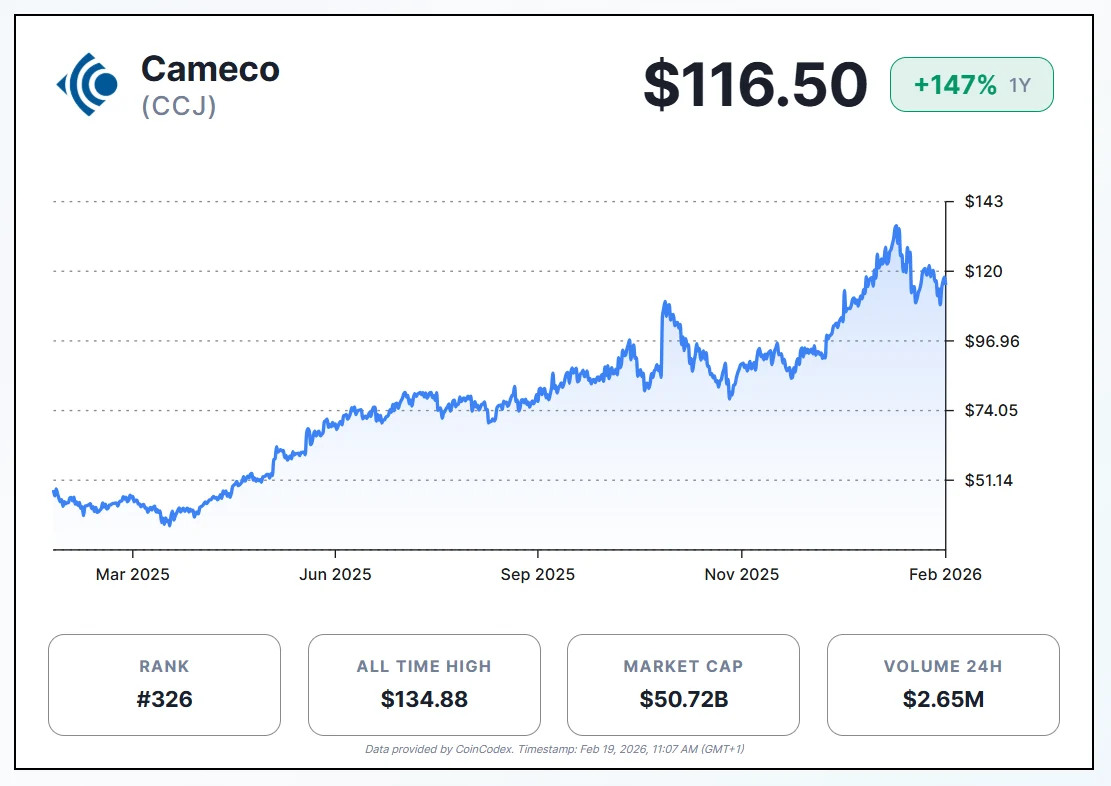

CCJ’s price over the past year (Source: CoinCodex)

Investor Takeaway: Cameco is often recommended for investors looking for lower volatility exposure to the uranium sector with robust fundamentals.

2. Kazatomprom (LSE: KAP)

Overview: Kazatomprom, which is headquartered in Kazakhstan, is the world’s largest uranium producer, and it accounts for a huge portion of global supply. Kazakhstan’s in-situ recovery production methods have helped keep costs relatively low, making Kazatomprom a dominant and efficient player in the space.

Strategic Position: With its scale and resource base, Kazatomprom plays a central role in supplying utilities globally. While production growth may be modest in the near term, its leadership position gives investors direct exposure to uranium’s global demand outlook.

Investor Takeaway: For investors looking for deep commodity exposure and a globally dominant producer, Kazatomprom is a key uranium stock to watch in 2026.

3. NexGen Energy (NYSE: NXE)

Overview: NexGen is a development-stage uranium company with high-quality assets in Canada’s Athabasca Basin — one of the richest uranium regions in the world. Its flagship project promises high uranium grades and long-term production potential.

Growth Potential: Unlike established producers, NexGen’s value comes from future production and exploration success. This “growth play” profile can offer major upside if its flagship deposit moves toward commercial production.

Investor Takeaway: This stock is best suited for investors with a longer time horizon and a tolerance for early-stage resource risk, as its production and cash flow timelines are longer.

4. Paladin Energy Ltd (ASX: PDN)

Overview: Paladin Energy is an Australian-based uranium producer with key assets, including the Langer Heinrich mine in Namibia, which recently increased production and improved output. Analysts have shown a strong bullish outlook based on onsite momentum and performance.

Strategic Moves: Paladin’s ramp-up of production and strategic acquisitions position it to benefit from rising uranium demand and higher global prices.

Investor Takeaway: Paladin is a good mid-tier uranium stock for investors seeking production growth and exposure outside of North America’s major producers.

5. Energy Fuels Inc. (NYSE: UUUU)

Overview: Energy Fuels is a US diversified uranium miner and mill operator. It has historically been one of the largest uranium producers in the United States and operates multiple assets, including key processing facilities.

Why Investors Watch It: With serious US government interest in domestic critical mineral production and nuclear fuel supply security, Energy Fuels benefits from supportive policy tailwinds alongside the uranium market growth.

Investor Takeaway: This stock is compelling for investors who want exposure to both uranium mining and refining, and those focused on US energy policy-driven assets.

Final Thoughts

The uranium sector is influenced by long-term global energy trends, including rising nuclear power demand and tighter supply from years of underinvestment in new mining projects. Investing in uranium stocks offers exposure to this dynamic market, but it’s important to balance potential growth with risks like commodity price volatility and geopolitical factors.

Learn#Uranium #Stocks #Buy1771500526