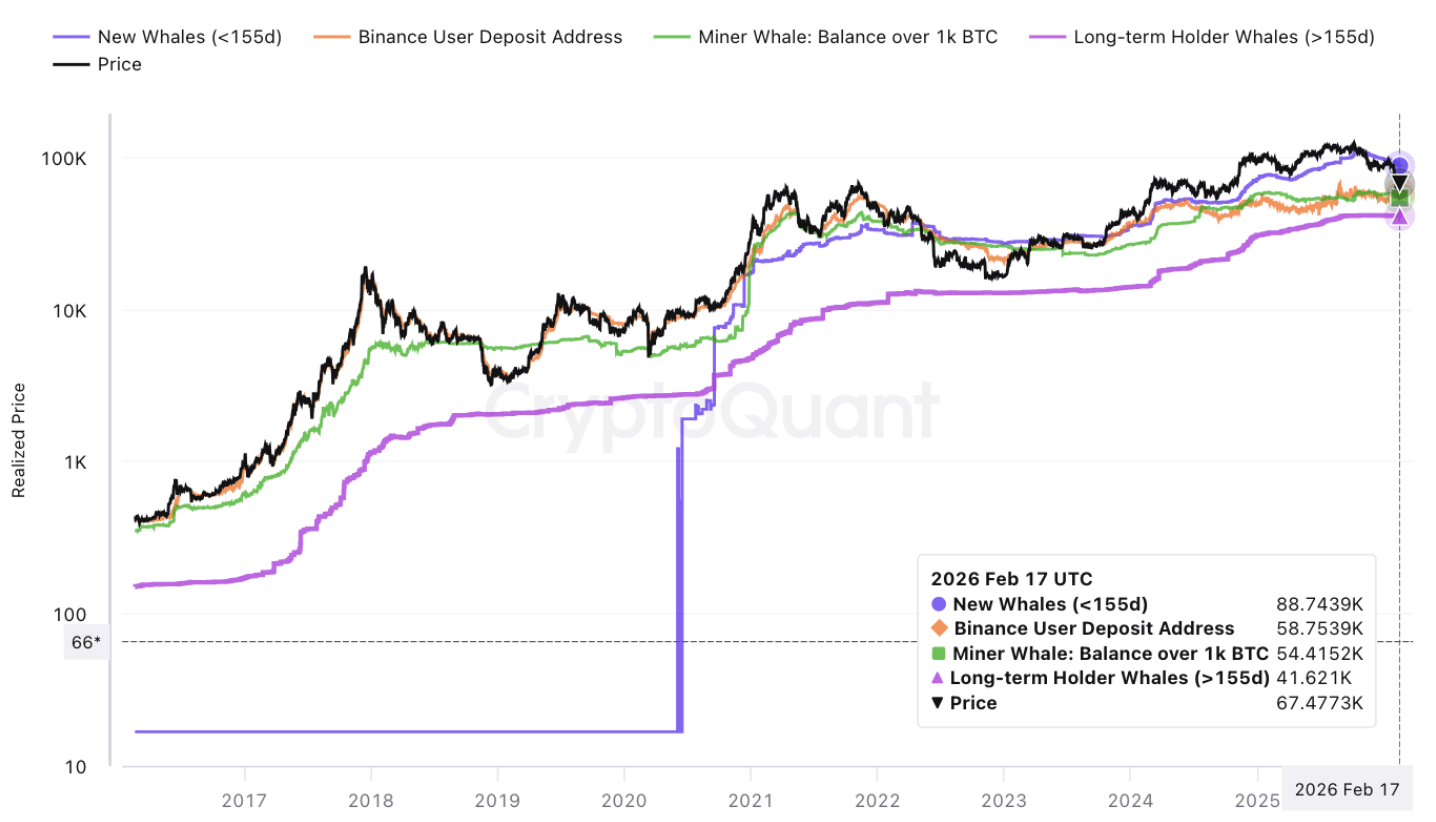

CryptoQuant analyst Burak Kesmeci has identified four realized price levels that may define Bitcoin’s long-term direction after the asset lost the $88,700 cost basis of new large holders. According to his analysis, that breakdown marked the transition into a classic bearish phase.

Realized price represents the average acquisition cost of coins for specific holder groups. When clusters of Bitcoin share similar realized prices, those levels often act as psychological and structural support or resistance.

Bitcoin Support Levels Now Cluster Between $58K and $54K

After losing the $88,700 level, the next key zone sits at $58,700, the realized price of Binance deposit addresses. This is viewed as the nearest downside magnet between current prices and the broader network realized price at $54,700.

Historically, when Bitcoin drops below the cost basis of new major holders, price tends to retest the overall network realized price. That places $54,700 in focus if $58,700 fails to hold.

The final and deepest of the four tracked levels stands at $41,600, the realized price of older large holders.

Together, the four levels now shaping the downside roadmap are:

- $88,700

- $58,700

- $54,700

- $41,600

These price zones are not predictions but structural reference points derived from on-chain cost data.

46% of Bitcoin Supply Now in Unrealized Loss

Parallel data from CryptoQuant shows a sharp deterioration in sentiment. Approximately 46% of Bitcoin’s circulating supply is now in unrealized loss – the highest reading since late 2022.

Another CryptoQuant analyst, Darkfost, noted that daily realized losses exceeded 30,000 BTC on February 5. While elevated, that figure remains well below the 80,000-92,000 BTC daily peaks seen during the 2022 bear market.

This suggests growing capitulation pressure, but not yet the extreme panic levels associated with prior cycle bottoms.

Bitcoin has since rebounded from sub-$60,000 levels, yet the broader technical and on-chain backdrop remains fragile.

Capitulation Alone Does Not Mark the Bottom

Historical data show that in 2022, realized loss peaks occurred months before Bitcoin formed its ultimate bottom. Capitulation tends to unfold gradually rather than resolve at a single price.

Today’s environment also differs structurally from 2022. The prior bear market was driven by internal industry failures and systemic collapses. Current pressure is largely tied to macroeconomic caution and tight monetary policy.

That distinction raises a key question: can realized price levels serve as reliable anchors when the dominant market driver sits outside the blockchain?

For now, the four realized price levels offer a measurable framework for assessing downside risk, but they do not guarantee where or when the cycle will turn.

News#Bitcoin #Price #Eyes #55K #CryptoQuant #Realized #Levels #Signal #Risk1771578235