Bitcoin is evolving into something very different from its original speculative form, and a tokenized yield-bearing gold stablecoin, Streamex GLDY, launching on 25 February, shines a light on what that future holds.

Market watchers will have noticed that gold has been trading like Bitcoin these past few weeks, displaying the sort of volatility once reserved for digital assets. On 30 January, spot gold fell by as much as 12% intraday, a day after printing its all-time high of $5,592.85 per ounce.

Yet, as the largest concentration of US military firepower in the Middle East since the 2003 invasion of Iraq gathers, gold is moving back above $5,000. It won’t be long before it tests its all-time high.

The rush of money into precious and semi-precious metals is happening when Bitcoin’s lustre as digital gold has seemed to fade. While gold has soared 17.7% year to date, despite its recent violent pullback, Bitcoin has moved in the opposite direction, down 23.2%.

However, it would be a mistake to write off Bitcoin and to fail to read the writing on the wall as tokenization momentum picks up, bringing the financial world even more into alignment with Bitcoin.

As gold becomes more tokenized, and as in the case of GLDY, yield-bearing too, the visibility of the present reality and future potential of Bitcoin as a source of income also comes into view. Tokenized gold helps shine a light on Bitcoin’s yield potential.

Bond Yields, Gold, and Bitcoin at $1 Million – the Eric Trump Speaks

At the World Liberty Financial conference at Mar-a-Lago this week, Eric Trump was dismissive of investing in boring bonds…

“If you don’t have the backbone, the wherewithal to weather volatility, go invest in some boring bond that’s going to yield you 4.5% and call it a day,”

But let’s look past his Bitcoin boosterism for a moment and remind ourselves what most rich people already know – that amassing wealth is all about reinvesting income. Fixed income is still the senior market for good reason.

There are plenty of investors out there who will jump at the chance of investing in, say, a $1,000 bond yielding 4.5%. Compounded over 10 years, and that $1,000 turns into $1,552, representing a total return of 55.3%.

Now let’s apply that yield-capturing approach to gold, but also add in the capital returns as the price of gold soars.

Do similar for Bitcoin. If Eric Trump is right, Bitcoin is headed for a $1 million price tag, and the asset’s compounding yield returns would rocket – assuming you had loaned out your Bitcoin using a suitable financial instrument.

How the Streamex GLDY Token Marries Gold Upside with Steady Compounding Income

Gold bugs and Bitcoin maximalists have yearned for ways to conveniently marry the hard-money properties of both to an income stream.

The world’s first yield-bearing gold stablecoin is about to provide the solution for gold investors, and the existing tokenized gold stablecoin players should take notice.

Streamex (NASDAQ: STEX) is the special purpose vehicle issuer of the gold-backed GLDY yield-bearing token.

Each unit represents 1 ounce of vaulted LBMA bullion and pays up to ~4% APY in-kind through a partnership with Monetary Metals.

GLDY loans its gold to Monetary Metals, which then leases it to gold users such as miners, refiners, and jewelry makers. The fees paid by the leasees (in gold) are the source of the yield, which is distributed to GLDY token holders monthly. Redemptions can be made at three months’ notice.

Purchasing GLDY is similar in effect to buying a gold ETF, but without the storage costs passed on to unit holders in the fund management fees. And of course, the other difference is that gold ETFs don’t pay a yield.

Transparent proof-of-reserves and pricing data are delivered using Chainlink’s oracle services, bringing the gold stablecoin’s collateral and yield infrastructure to TradFi and DeFi.

Streamex Co-Founder Morgan Lekstrom Breaks it All Down For Cryptonews

Image: Morgan Lekstrom, Executive Chairman & Co-Founder, Streamex

Cryptonews reached out to Streamex co-founder Morgan Lekstrom to find out more about the project.

He is a mining and capital markets veteran with years of experience in EXIM-backed critical metals projects and gold-sector M&A.

He recently took up the role of Streamex Executive Chairman.

“The GLDY presale is a private offering of up to 100 million USD (expandable) conducted via our own infrastructure, not a separate Nasdaq‑listed security,” says Lekstrom.

“Streamex, the underlying technology company, trades on NASDAQ, ticker STEX. The GLDY product is an institutional-grade tokenized security asset that is 1:1 backed by gold, providing a compounding yield of up to 4 percent in gold.

“The presale target was $100m, as it’s a rolling fund, we will continue to add as the market grows. It scales quickly.”

Streamex is building a full real-world assets (RWA) stack for GLDY that includes cross-chain interoperability, oracle-secured proof-of-reserves, and a tZERO ATS for regulated US secondary trading.

A gold-anchored corporate balance sheet will back all of this infrastructure. There are even tentative plans for an ETF wrapper to make it even more appealing to investors.

Streamex has also announced that its Yorkville-secured convertible debenture is now fully settled.

The company currently has more than $50 million in cash after raising $40.25 million (minus expenses) from investors in January this year through two issuances totaling 13,416,667 shares of common stock.

Addressing the mechanics of the yield accrual, Lekstrom explains:

“Each GLDY is backed by one fine troy ounce of physical gold, and the yield is paid directly in additional GLDY tokens representing additional ounces of gold.

“Investors holding GLDY accrue up to an anticipated 4% annualized gold‑denominated yield, which is indexed back into their position, allowing their gold exposure to compound over time.”

The ‘Tokenization of Everything’ Narrative is Gaining Traction

GLDY feels like the right product at the right time as tokenization gains traction.

So how does Streamex fit in beyond being the issuer and underlying technology company of the project?

“GLDY program is designed so that the gold lease yield flows to GLDY token holders in the form of additional GLDY, rather than as a dividend on Streamex Corp. stock,” Lekstrom explains.

“Streamex, as sponsor and service provider, participates economically via its role in structuring, operating, and co‑investing in the program, but owning STEX shares is distinct from owning GLDY and does not itself entitle a shareholder to GLDY yield.”

As far as corporate structure goes, technically speaking BioSig Technologies is the parent company of the Streamex SPV. Lekstrom breaks it all down.

“The current Streamex business reflects the 2025 combination between BioSig Technologies and Streamex Exchange Corp., which created a publicly listed real‑world asset tokenization platform on Nasdaq.

“The definitive share exchange agreement was signed in May 2025, and from that point forward, the combined company’s strategy has been centered on institutional‑grade tokenization and on‑chain commodities infrastructure rather than BioSig’s legacy medical‑technology focus.”

Streamex GLDY token is available to accredited investors and institutions.

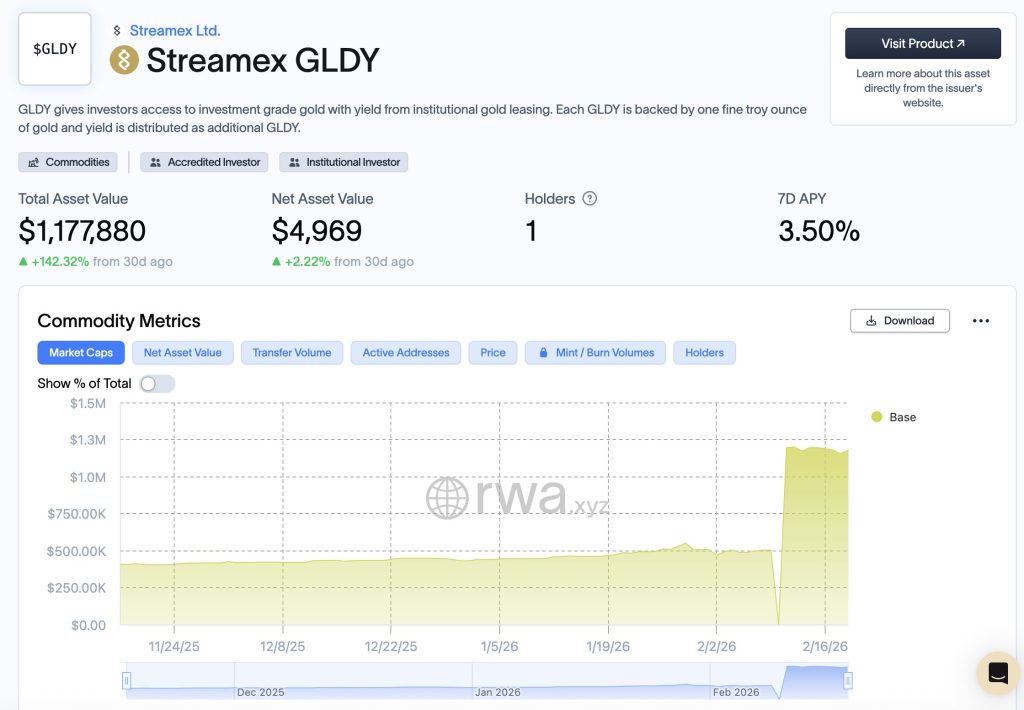

Image: RWA.xyz – GLDY starts trading on 25 February 2026

Is GLDY Going to Supplant Tether Gold (XAUT)?

In addition to holding huge amounts of gold in its treasury – circa 140 to 148 tonnes($23–$24 billion) – Tether is also the undisputed market leader in tokenized gold.

Tether Gold (XAUT) has a modest market capitalization of $2.6 billion. PAX Gold (PAXG) is not far behind, with a market cap of $2.27 billion, and Kinesis Gold (KAU) is in third place, valued at $391 million.

There are dozens of other projects planning launches, as well as launches by new, smaller tokens trying to offer something a little different.

What’s interesting and different about this particular gold stablecoin is its yield-bearing properties.

The issue of yield is at the root of disagreements between bankers and crypto supporters in the US, delaying passage of the CLARITY Act.

A third meeting of bankers and crypto folks took place at the White House yesterday.

The bankers are still not budging on allowing stablecoins to earn yield, which they see as a threat to trillions of dollars in deposits at US banks – another reason, perhaps, why eyes will be on the GLDY launch.

What Works for Tokenized Yield-Bearing Gold Works for Bitcoin Too

What works for gold, as a demonstration of bringing yield-bearing products onto the blockchain, also works for Bitcoin.

Yield-bearing products have been around for a while, depending on the jurisdiction you reside in. Nexo has been a pioneer.

After a three-year hiatus with regulators that led to its being barred from the US, Nexo returned on 16 February.

You can earn between 3% and 6.5%, though to maximize your income stream, you will need to accept a portion of the yield in NEXO tokens rather than ‘in kind’ (BTC).

There are also yield-bearing Bitcoin exchange-traded products, if your broker provides access, as many of the most exotic crypto ETF flavors emanate from Europe.

For instance, the 1Valour Bitcoin Physical Staking (1VBS) ETP pays a yield of only 1.4%. That’s below the US inflation rate of 2.4%, but it is better than no yield at all.

Streamex GLDY is an ERC-20 token running on the Base blockchain and can be found on the real-world assets exchange RWA.xyz. The token begins trading on 25 February. The GLDY Litepaper is available on the project website.

The post Why Tokenized Yield-Bearing Gold Stablecoin GLDY Will be Great For Bitcoin appeared first on Cryptonews.

Exclusives,Features#Tokenized #YieldBearing #Gold #Stablecoin #GLDY #Great #Bitcoin1771598396

,

,  ) (@streamex)

) (@streamex)  Eric Trump says Bitcoin is going to hit $1,000,000

Eric Trump says Bitcoin is going to hit $1,000,000