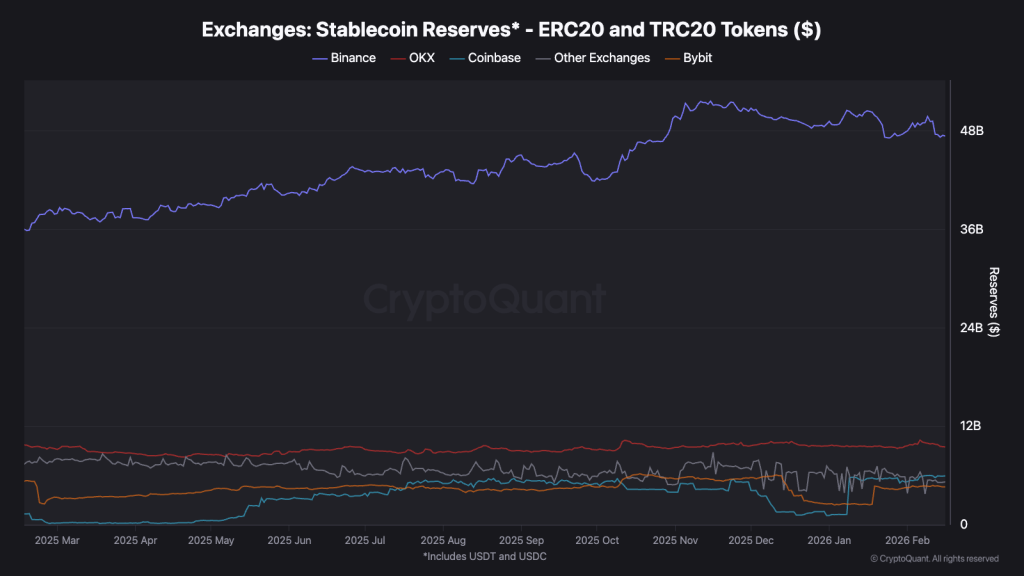

After tough week, Binance still tightining its grip on crypto. The exchange now controls 65% of all stablecoin reserves sitting on centralized platforms.

Right now, it holds about $47.5 billion in USDT and USDC alone. That is a massive chunk of crypto liquidity parked in one place.

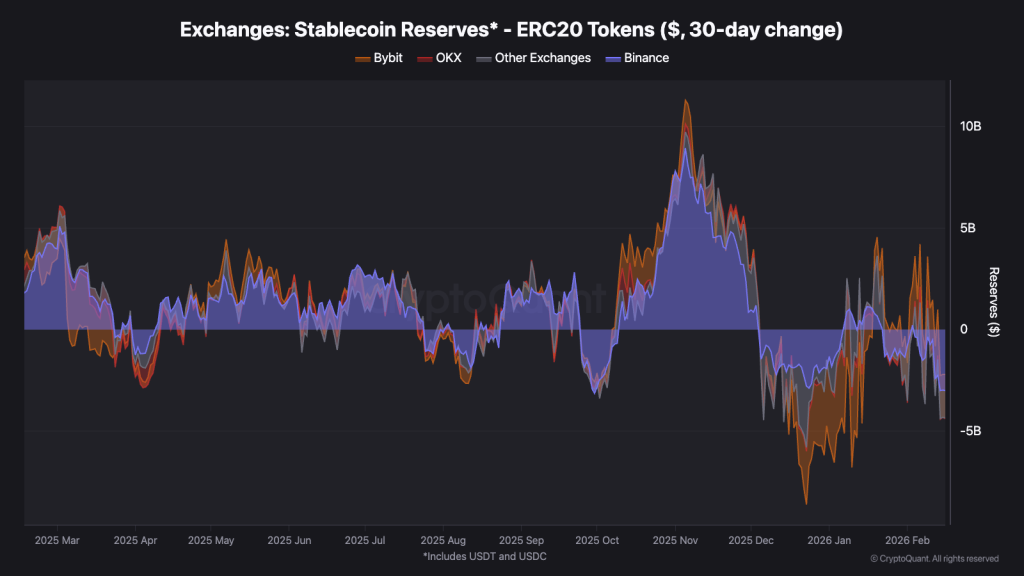

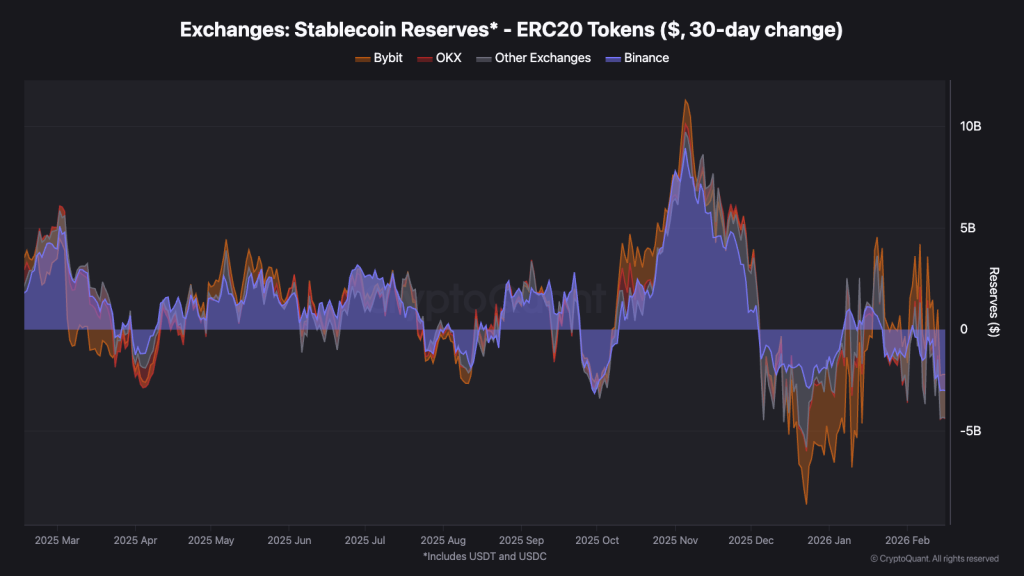

What makes it more interesting is the timing. Broader market outflows have cooled to around $2 billion. So while capital is not flooding in aggressively, Binance is quietly tightening its grip on the stablecoin supply.

In crypto, liquidity is power. And Binance is stacking a lot of it.

Key Takeaways

- Dominant Market Share: Binance now holds $47.5 billion in stablecoins, representing 65% of all CEX liquidity.

- Outflows Stabilize: Monthly stablecoin outflows have slowed to $2 billion, a sharp drop from the $8.4 billion seen in late 2025.

- Competitors Trail: Nearest rival OKX holds just 13% of reserves, highlighting a widening gap in exchange liquidity depth.

Why is Capital Consolidating?

Money is not running away from crypto. It is moving to where it feels safest. At the peak of the late 2025 panic, redemptions hit $8.4 billion. Now outflows have cooled to around $2 billion this month. That shift suggests rotation, not abandonment.

Instead of exiting the ecosystem, investors appear to be consolidating around deeper liquidity and faster execution. In tight conditions, traders care more about slippage and reliability than spreading funds across smaller venues.

That is why capital is clustering on the biggest platforms. When uncertainty rises, perceived safe havens attract the bulk of the flow.

Binance Stablecoin Data Breakdown

The scale of Binance lead is hard to ignore. Data shows the exchange now holds about $47.5 billion in stablecoins, up from $35.9 billion a year ago.

That is a 31% jump in twelve months. The growth followed a clear pivot after the BUSD wind down, with liquidity rotating heavily into USDT and USDC.

Meanwhile, rivals are far behind. OKX holds around $9.5 billion. Coinbase sits near $5.9 billion. Bybit trails with roughly $4 billion. The gap is not small. It is structural.

Recent reserve reports show Binance total reserves, including crypto assets, above $155 billion. When liquidity shifts on Binance, it tends to ripple across the market. That is how dominant its position has become.

The post Binance Controls 65% of CEX Stablecoin Reserves – What It Means for Liquidity appeared first on Cryptonews.

Blockchain News,Adoption,Binance,Exchange,Market,Stablecoin#Binance #Controls #CEX #Stablecoin #Reserves #Means #Liquidity1771344861