Indian crypto holders branch out beyond Bitcoin: Survey

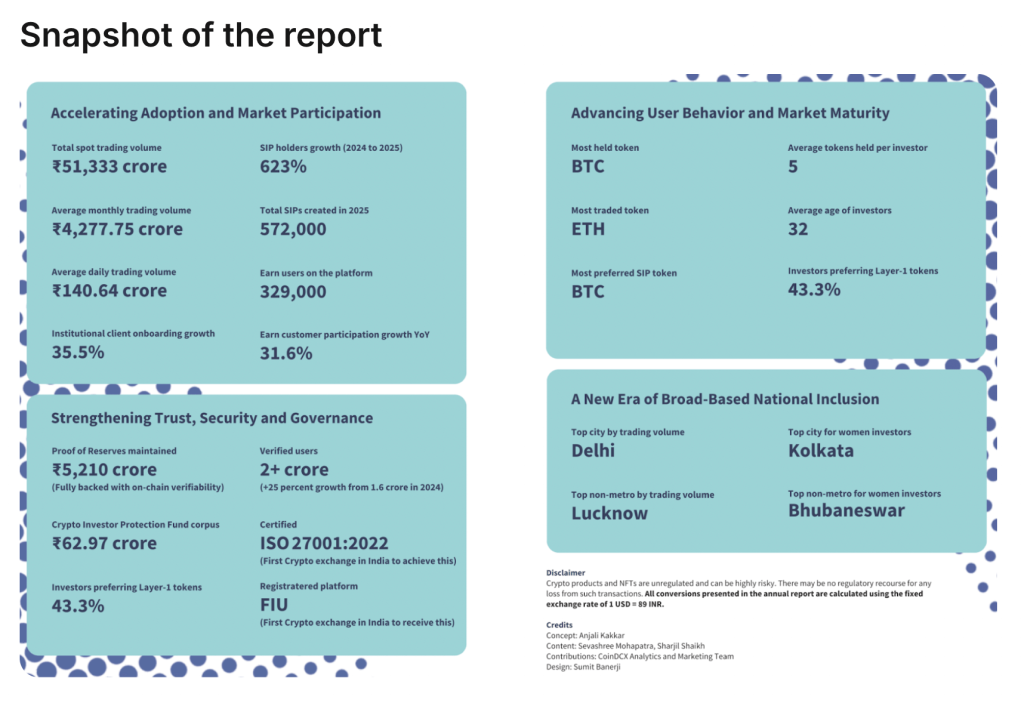

The average crypto holder on the popular Indian crypto exchange CoinDCX is starting to diversify their portfolio, according to recent survey results.

“The Indian crypto investor today holds an average of 5 tokens per portfolio,” CoinDCX said in an annual report released on Thursday. Its survey indicates the average investor in India has almost doubled the range of crypto tokens they hold, up from around two to three tokens in 2022.

CoinDCX said that investors are increasingly exploring the potential of other blockchain networks rather than focusing solely on Bitcoin.

“Investors are evolving beyond Crypto equals Bitcoin”

Layer-1 tokens were the most popular category, preferred by 43.3% of respondents, which CoinDCX described as “a clear indicator of research-driven diversification rather than single-asset speculation.”

Bitcoin followed with 26.5%, while memecoins accounted for 11.8% of investor preference.

The survey also highlighted the growing geographic spread of crypto adoption in India, with 40% of investors based in non-metro cities rather than major urban centers.

The findings come only months after Coinbase Ventures, the investment arm of the US-based crypto exchange Coinbase, invested an undisclosed amount in CoinDCX, amid the country’s bolstering crypto adoption.

CoinDCX recently claimed to serve more than 20 million customers in India and the United Arab Emirates, following its acquisition of local crypto exchange BitOasis in late 2024.

Ripple secures approval to expand operations in Singapore

Singapore’s central bank has given the green light to payment issuer Ripple to further expand services within the country.

“The @MAS_sg has approved an expanded scope of payment activities for our Major Payment Institution license – enabling us to deliver end-to-end, fully licensed payment services to our customers in the region,” Ripple said on Monday.

Ripple said the license will allow them to build the infrastructure that financial institutions need to “move money efficiently, quickly, and safely.”

Fiona Murray, Ripple Asia Pacific vice president and managing director, said that the Asia Pacific region leads the world in crypto usage, and Singapore sits “at the center of that growth.”

The Monetary Authority of Singapore (MAS) has been collaborating with a range of crypto companies in recent years to strengthen crypto innovation in the country.

Major crypto exchange Coinbase recently launched operations in Singapore, citing its “recent foundational work” with MAS as a key factor behind the decision.

Read also

Features

How to resurrect the ‘Metaverse dream’ in 2023

Columns

Wall Street disaster expert Bill Noble: Crypto spring is inevitable

The development comes as Ripple continues to engage closely with regulators worldwide. On Nov. 11, Ripple President Monica Long said she welcomed the UK’s Economic Secretary to the Treasury, Lucy Rigby, to Ripple’s Singapore office.

Japan to tax crypto like stocks in big shake-up

Japan is reportedly considering a plan to set a flat tax on cryptocurrency gains at 20%, aligning it with the tax treatment of stocks and other investments.

If implemented, the change may provide significant relief for high-income earners. Under the current tax system, crypto gains are combined with salary and other income and can be taxed at rates of up to 55%, according to a report published by Nippon on Monday.

Read also

Features

Crypto scoring big with European football

Features

Justin Aversano makes a quantum leap for NFT photography

Many market participants anticipate this to be a bullish move for the country and potentially one that will lead to more capital flowing into the crypto sector.

It was only a few months ago that Dragonfly Capital managing partner Haseeb Quirishi said, “Japan is a sleeping giant in crypto.” Meanwhile, Kaia’s official account said on Monday that, “Japan’s 20% flat tax puts it ahead of most Asian countries on crypto.”

The move comes as the government is also reportedly planning tighter regulation of crypto assets next year.

On Nov. 21, it was reported that the Financial Services Agency in Japan will require cryptocurrency exchanges to maintain liability reserves as part of measures to guard against hacks or unforeseen events.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Ciaran Lyons

Ciaran Lyons is a Cointelegraph staff writer covering cryptocurrency markets and conducting interviews within the digital asset industry. He has a background in mainstream media and has previously worked in Australian broadcast journalism, including roles in national radio and television. Prior to joining Cointelegraph, Lyons was involved in media projects across news, documentary, and entertainment formats. He holds Solana, Ski Mask Dog, and AI Rig Complex above Cointelegraph’s disclosure threshold of $1,000.

Read also

Hodler’s Digest

VanEck files for Solana ETF, Ether supply inflates, and more: Hodler’s Digest, June 23-29

Editorial Staff

5 min

June 29, 2024

VanEck seeks approval for Solana ETF, ETH supply rises 73 days in a row, and Satoshi-era wallet moves Bitcoin.

Read more

Columns

Roger Ver’s next life: Cryonics meets crypto

Andrew Fenton

14 min

April 28, 2021

“I considered killing myself temporarily, going into cryonic suspension and then coming out later, when the technology is better, to avoid going to prison.”

Read more

Asia Express,Columns,Features#Indian #investors #Bitcoin #Japan #soften #crypto #tax #Asia #Express1768777698