Shiba Inu continues to trade under pressure, failing to break above the $0.000006476 resistance level. The token dropped 3.20% in the last 24 hours, compounding a 20.5% decline over the past month. Despite a modest 8.8% weekly recovery, SHIB remains near its lowest levels in recent months.

The broader cryptocurrency market’s total market capitalization sits at $2.31 trillion, down 1.04%, with Bitcoin leading losses at a 1.28% decline. Investor sentiment has deteriorated sharply. The CMC Fear & Greed Index registers a reading of 12, firmly in Extreme Fear territory, signaling that caution dominates trading decisions across the market.

For meme coins like SHIB, which depend heavily on speculative momentum, these conditions are particularly damaging. Without bullish sentiment driving retail participation, price recovery becomes increasingly difficult.

Meme Coin Sector Faces Broad Selling Pressure

SHIB does not suffer alone. The total meme coin market cap stands at $36.1 billion, slipping 0.1% in the past 24 hours. Fellow meme tokens, including DOGE, PEPE, and BONK, have all registered losses. The synchronized decline across the sector points to a structural retreat rather than any SHIB-specific issue.

Retail investors tend to rotate out of meme coins during periods of uncertainty. That behavior is clearly visible now. When Bitcoin weakens, and fear dominates sentiment, assets with limited utility face the sharpest outflows. SHIB fits that profile. The absence of a near-term catalyst makes a rapid reversal unlikely under current conditions.

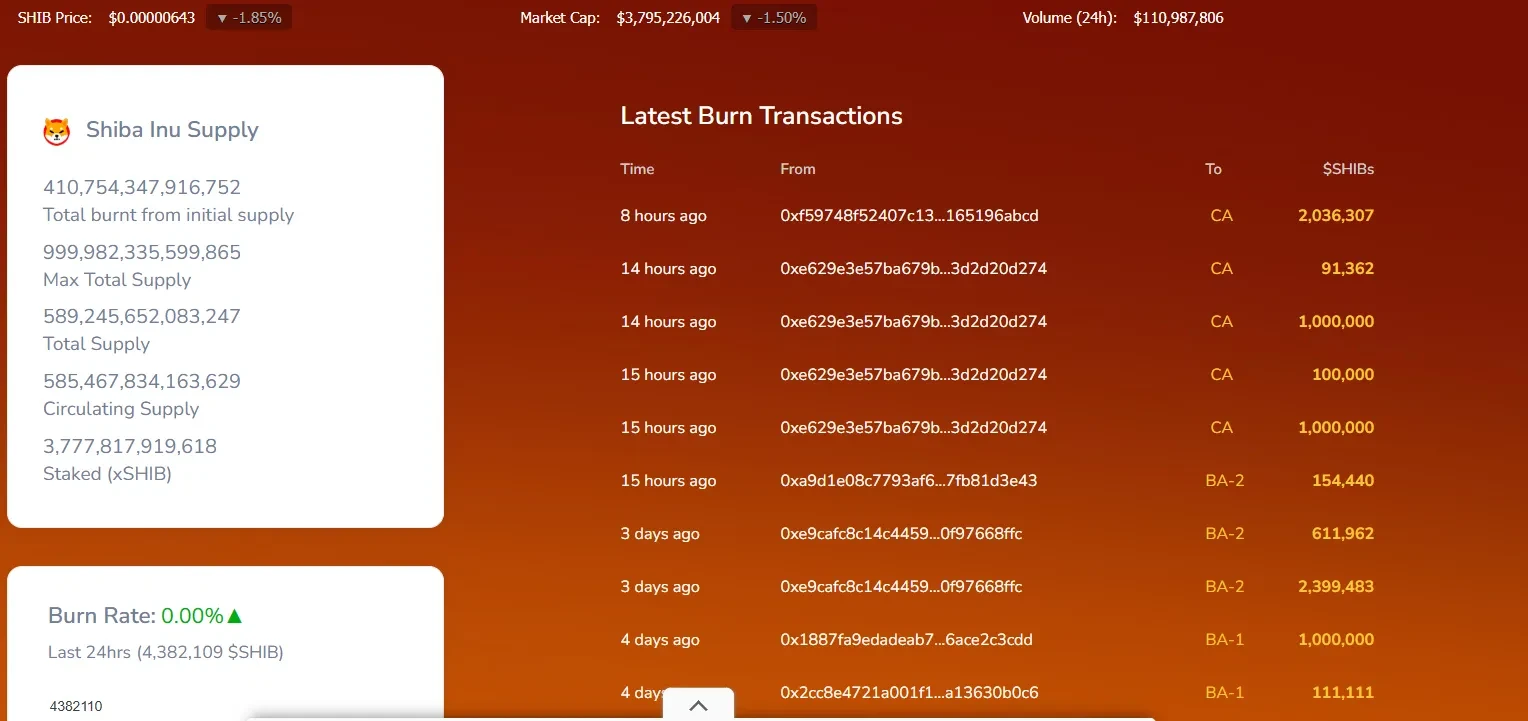

Token burns have not provided meaningful relief. Only 4,382,109 SHIB tokens were burned in the most recent 24-hour period. Given SHIB’s total circulating supply running into the hundreds of trillions, that figure is negligible.

Technical Indicators Point to Neutral, Not Recovery

From a technical standpoint, SHIB is consolidating between established levels. Support holds near $0.00000600, while resistance sits at approximately $0.00000750. The token has been moving within this range for several days without a decisive break in either direction.

The MACD offers little guidance. The MACD line and signal line are nearly identical in value, reflecting a market in equilibrium. Neither buyers nor sellers have established clear control. This kind of reading typically precedes a directional move, but timing that shift remains uncertain.

The RSI reinforces the neutral outlook. At approximately 45, it sits just below the midpoint of 50. The token is not oversold, which limits the case for an immediate bounce. It is also not overbought, ruling out imminent selling pressure from that indicator alone. Traders watching for momentum signals will need to wait for a clearer setup before committing to a position.

A break above $0.00000750 would represent a meaningful technical development, potentially attracting fresh buying interest. Conversely, a close below $0.00000600 could accelerate losses and bring new support zones into play further down the chart.

News#Shiba #Inu #Price #Falls #Monthly #SHIB #Recover #Bearish #Market #Conditions1771445116