Solana stabilized after a steep selloff, as short term trading compressed into a tight range on lower time frames. Meanwhile, a higher time frame breakdown kept focus on whether the market can defend the next key support bands.

Solana Holds Range as Bluntz Flags Early Accumulation Signs

Solana traded near $83 on the 4-hour SOLUSD chart on Coinbase after an extended decline that pushed price well below major moving averages. The broader trend remained bearish, as SOL stayed under the 50-period, 100-period, and 200-period simple moving averages. At the time of the chart, the 50 SMA sat near $83.80, the 100 SMA near $85.43, and the 200 SMA near $104.05. Therefore, overhead resistance clustered above the current price zone.

Solana U.S. Dollar 4 hour chart. Source: TradingView / X

However, price action began to compress into a defined range between roughly $78 and $92. Within this box, SOL printed a sequence of lower lows followed by a modest rebound and then another dip, which the analyst marked as an A-B-C structure. As a result, price stopped trending in a straight line lower and instead moved sideways. This shift suggested a pause in downside momentum rather than a confirmed reversal.

In a post on X, trader Bluntz said he still believes the Solana bottom is forming in this area and described the current price action as the early stage of accumulation. According to his view, the market is absorbing sell pressure after the sharp drawdown. Meanwhile, the chart projection sketched a choppy base, followed by a gradual push higher toward the upper boundary of the range and later into the mid-$90s area. Even so, the projection remained a scenario rather than a confirmed outcome.

Momentum indicators reflected the same hesitation. The 14-period RSI hovered in the mid-40s, which showed neither oversold conditions nor strong bullish momentum. Therefore, sellers no longer controlled the move with the same force as during the prior leg down. At the same time, buyers did not yet show enough strength to reclaim key moving averages. As long as SOL trades below the 100- and 200-period averages, the broader trend remains under pressure, even if the market continues to build a base inside the range.

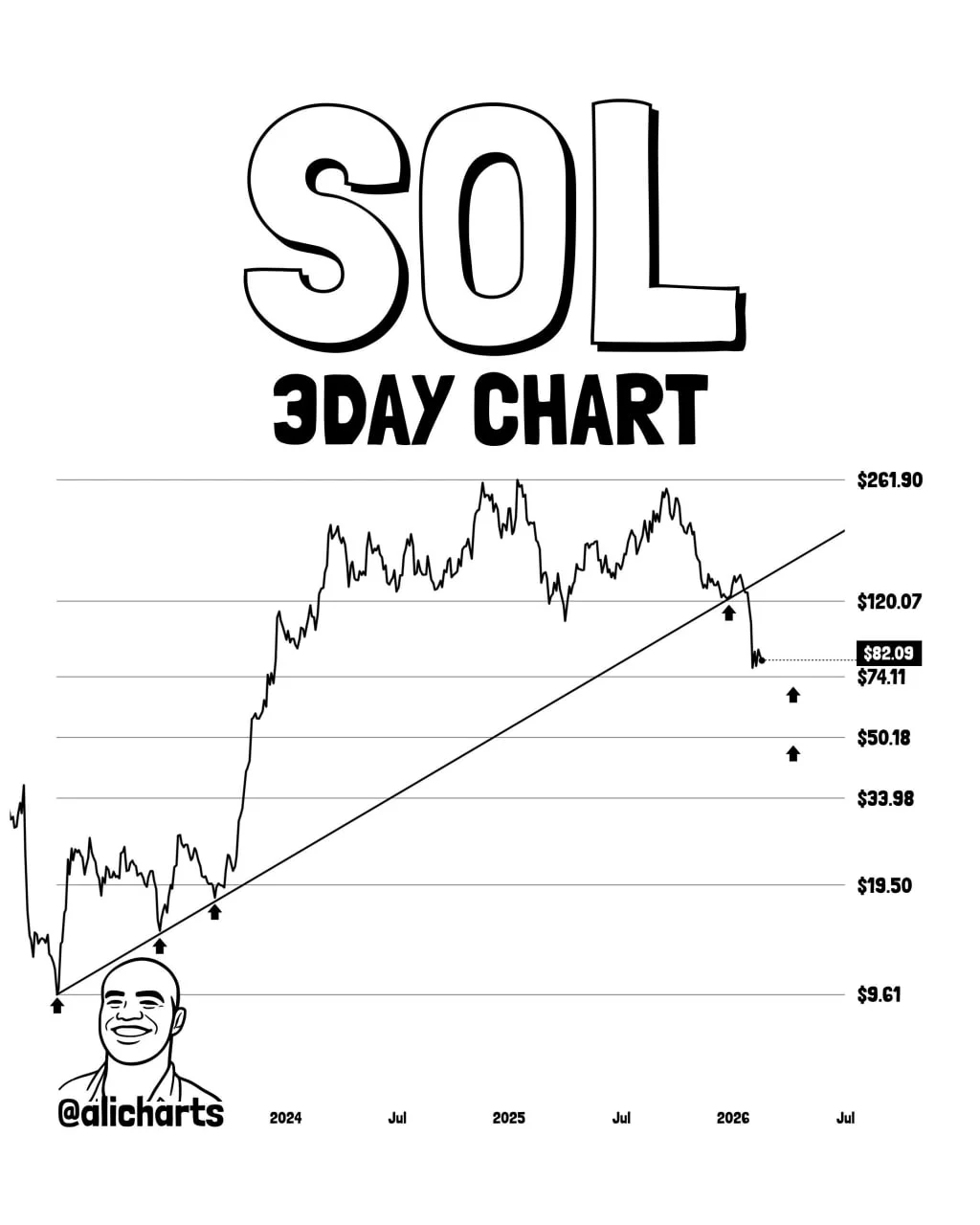

Solana Slips Below Long Trendline as Ali Charts Flags Lower Support Zones

Solana broke below a rising trendline that guided price action through much of the prior cycle, based on a 3-day chart shared by market analyst Ali Charts. The trendline connected multiple higher lows from 2023 into 2025. Once price lost that structure, the broader market structure shifted from trend support to downside continuation. As a result, the chart now shows a clear loss of long-term momentum.

Solana 3 day chart. Source: Ali Charts

The chart also highlighted several horizontal levels that acted as prior reaction zones during earlier phases of the cycle. Those levels served as support during the advance and later as reference points during pullbacks. After the breakdown, price moved away from the former trendline and failed to reclaim it on subsequent attempts. Therefore, the long-term uptrend no longer acts as support and instead marks an overhead technical barrier.

In a post on X, Ali Charts said the next key downside areas to watch sit at $74.11 and $50.18. Both levels align with earlier consolidation zones where price paused before previous expansions. As a result, market participants often track these zones as potential reaction areas during extended declines. The chart also shows deeper historical levels below, which reflect prior accumulation ranges from earlier cycle phases.

Momentum on the higher time frame weakened after the break, as swings began to compress lower rather than expand upward. At the same time, volatility expanded during selloffs, which reflected stronger follow through on downside moves. Therefore, the structure on the 3-day chart shifted from trend continuation to trend repair, with price needing to reclaim former support levels to alter the broader bias.

News#Solana #News #SOL #Trapped #Tight #Range #Massive #Selloff1771694408