Deutsche Bank is expanding its use of Ripple’s payment infrastructure as the bank seeks to modernize global settlement systems. The move comes as XRP continues to trade under pressure, with on-chain data and cycle models pointing to the possibility of a deeper market bottom. The partnership is an important development for blockchain adoption in international banking.

The bank aims to shift away from traditional payment systems that depend on multiple intermediaries. These structures often slow transactions and increase costs for institutions that rely on cross-border settlement. Deutsche Bank plans to integrate distributed ledger tools to address these issues. The initiative, as a result, is designed to create faster transfer routes and reduce settlement delays across major currencies.

Deutsche Bank Expands Ripple Integration

According to reports from Der Aktionar, Deutsche Bank is now working with Ripple Payments as part of a broader effort to reshape how international transfers are executed. The bank is also taking part in an industry effort that seeks to introduce a blockchain-powered ledger within the SWIFT ecosystem. More than forty institutions are involved in the project.

Ripple’s infrastructure allows institutions to send value directly rather than routing payments through several correspondent banks. This approach removes many layers of fees and reduces delays. The bank expects settlement windows to shrink from days to seconds. Deutsche Bank also aims to improve transparency for clients who track multi-currency flows across global markets.

The institution is updating systems that were built around SWIFT messaging. While SWIFT remains the global standard for payment instructions, settlement can still take extended periods due to intermediary chains. By using Ripple-based rails, the bank can verify transactions on a shared distributed ledger and remove the need for repeated confirmations. Estimates suggest distributed ledger tools may reduce operational expenses in global payments by up to 30%.

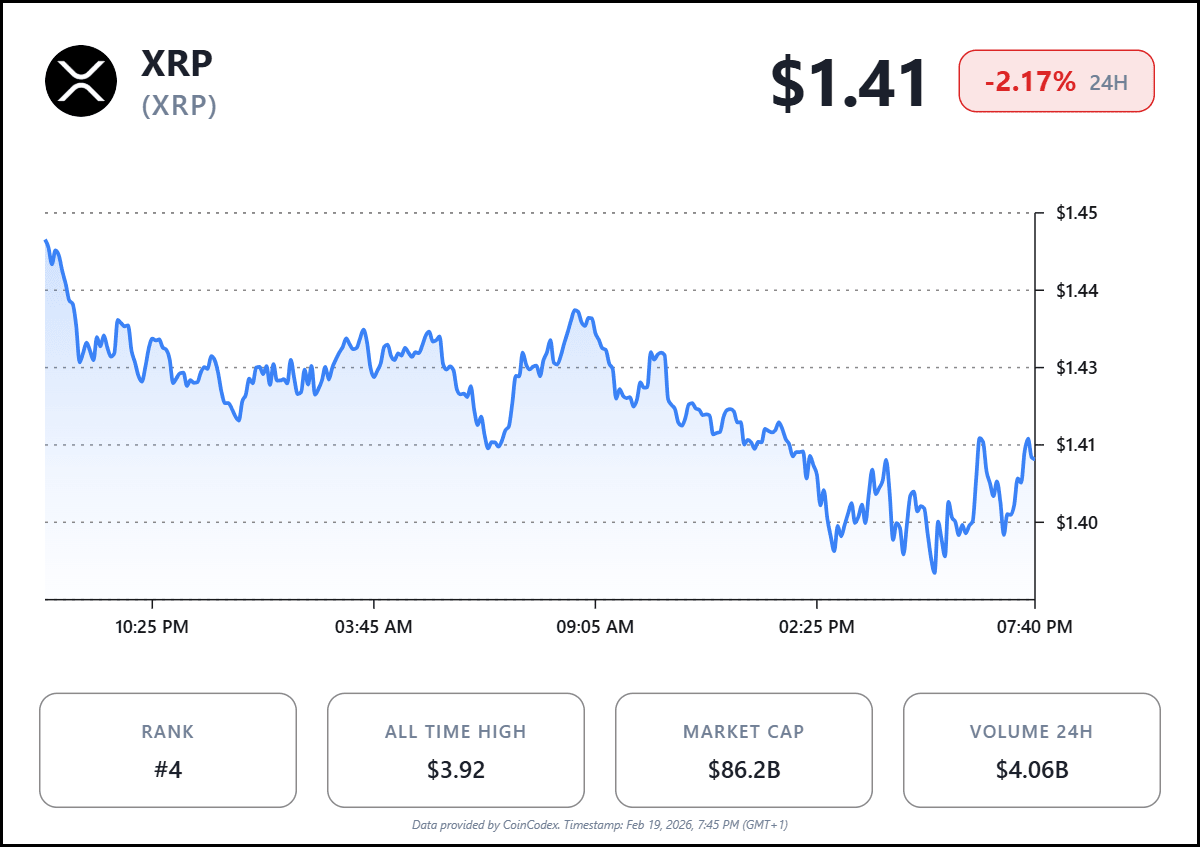

XRP Price Trades Lower as Market Conditions Weigh

The partnership comes as XRP trades in a bearish environment. The asset has dropped about 60% from the 2025 all-time high of $3.66. Market pressure increased early this month as XRP lost the $1.5 support zone. The decline continued into February, and XRP fell to a 15-month low of $1.11 before recovering to about $1.41.

Many traders believe the $1.11 low could represent the bottom of the current cycle. However, some analysts say historical patterns point to the possibility of a deeper move. Market technician EGRAG Crypto presented a cycle math model suggesting that each cycle bottom tends to be 2.8 times higher than the previous one. Based on this structure, a bottom near $0.78 is possible. The projected range places support between $0.75 and $0.85.

XRP saw major sell pressure during the February downturn. A single two-day drop pushed the asset close to the current cycle low. Analysts say the market remains sensitive to macro conditions and liquidity swings across the broader crypto sector.

Analysts Diverge on Long-Term Projections

While cycle models show the potential for a deeper short-term decline, long-term projections remain mixed.

As we earlier reported, Standard Chartered recently reduced its end-2026 XRP target from $8 to $2.80 due to short-term market conditions. The bank said the downgrade reflects reduced liquidity and weaker sentiment across digital assets.

However, Standard Chartered has kept its 2030 forecast at $28. The firm said long-term adoption of cross-border tokenized settlement could raise demand for digital assets that support institutional payment networks. At press time, the XRP price was trading at $1.40, a 4.38% decline from the 24-hour resistance level.

News#XRP #Price #Prediction #69B #Deutsche #Bank #Partners #Ripple1771530377